Summaries from Days 6-10 of Nebraska Bill Introduction

The First Regular Session of the 109th Nebraska Legislature convened on January 8, 2025. As of January 25, 77 legislative days remain in the session. The Legislature plans to adjourn sine die on June 9, 2025.

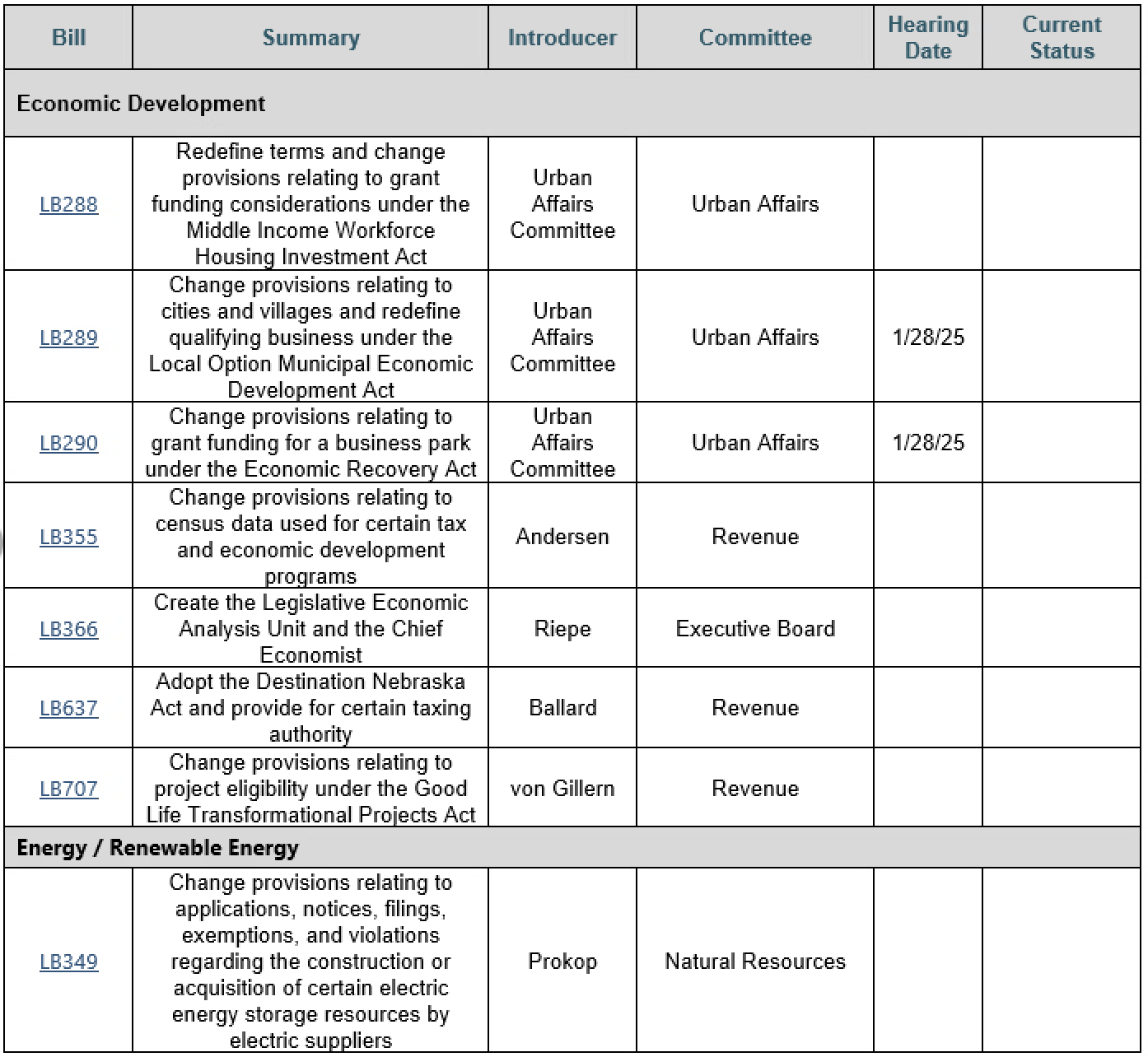

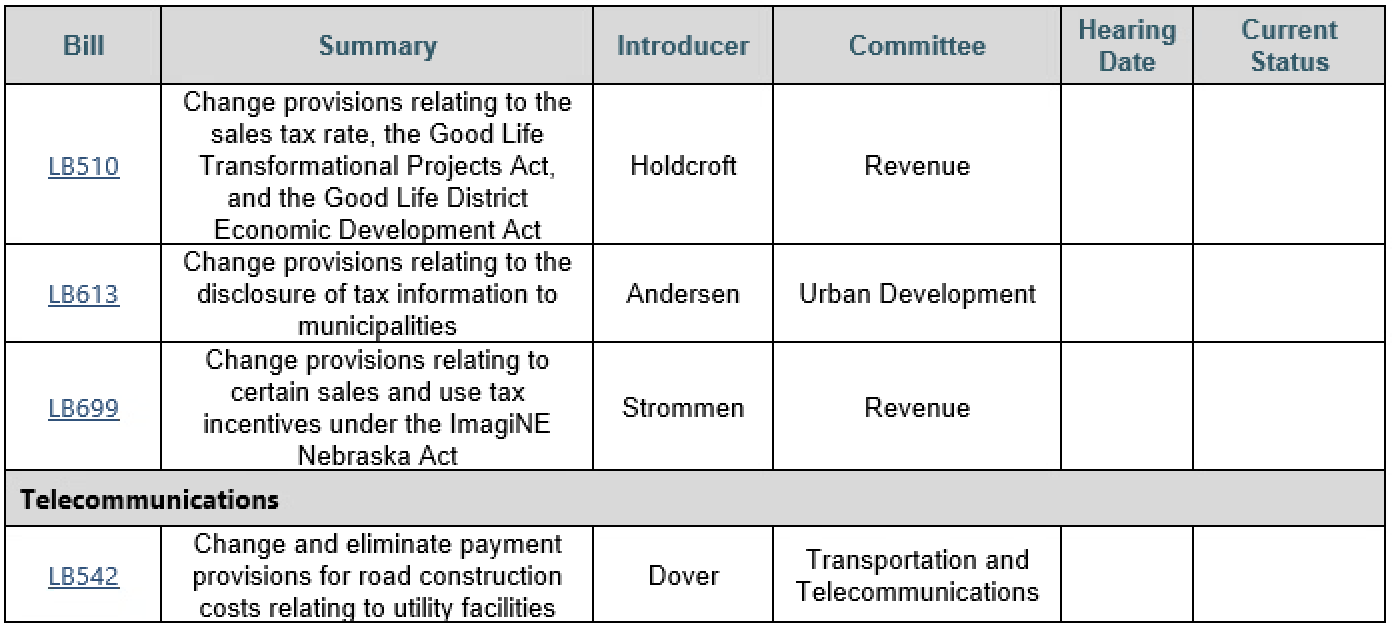

Bill introduction concluded on January 22, 2025. Through days 6-10 of bill introduction, we identified 46 bills that could significantly impact land use, real estate and energy law in Nebraska. Below are summaries of those bills. A chart is available at the end of this article. You may also find summaries from days 1-5 of bill introduction HERE.

The first five bills we outline in greater detail below, however, will be of particular interest to those working within the real estate and renewable energy industries:

LB331 (Hardin) proposes to create the Nebraska EPIC Consumption Tax Act (EPIC standing for “the elimination of property, income, and corporate taxes”). The Act would repeal the state income, sales and use taxes the Nebraska Revenue Act of 1967 currently imposes. It would also repeal the property tax Chapter 77 of the Nebraska Revised Statutes currently imposes. Further, it would repeal the motor vehicle tax, the motor vehicle fee and the inheritance tax as sections 60-3,185, 60-3,190 and 77-2001 through 77-2040, respectively, currently impose. This would end the imposition of these taxes and fees at the end of the day on December 31, 2027.

The bill would also establish that Nebraska shall never impose or collect an income tax nor a property tax on property a citizen already owns moving forward. Further, it would establish a new consumption tax on certain taxable property and services. The bill would set the rate at seven and one-half percent (7.5%). The bill would then establish greater parameters for imposing and collection the consumption tax. Finally, the bill would create several fund programs and review boards, aiming to stabilize areas such as education and county-level expenditures. On January 21, 2025, the Legislature referred this bill to the Revenue Committee.

LB458 (Bostar) proposes to establish the Permitting Approval Timeliness Act. The Act would ensure any entity responsible for reviewing applications and issuing permits would complete the process within sixty (60) days of submission. The bill would also provide provisions for the event of application denial, appeal standards and automatic permit approval if the reviewing entity did not provide a final decision within sixty (60) days.

Further, the bill would establish the By-Right Housing Development Act. The Act aims to address housing shortages and promote housing affordability across the state by streamlining the approval process for by-right housing development. On January 23, 2025, the Legislature referred this bill to the Urban Affairs Committee. The bill is set for a hearing on January 30.

LB468 (Clements) would amend the Nameplate Capacity Tax for renewable energy generation facilities that section 77-6203 of the Nebraska Revised Statutes currently regulates. Currently, developers must pay the Nameplate Capacity Tax at a rate of three thousand five hundred eighteen dollars ($3,518) per megawatt of capacity. The bill would amend this rate to six thousand five hundred sixty ($6,560) per megawatt. Further, the bill would allow the Department of Revenue to adjust this rate on January 1, 2027 and every consecutive year on January 1 to reflect more modern property tax rates. On January 23, 2025, the Legislature referred this bill to the Revenue Committee.

LB503 (Bosn) would provide a new avenue to incentivize renewable energy development across Nebraska. Under the bill, a county board can turn its county into an “American energy friendly county.” By becoming an American energy friendly county, a county would loosen its standards for private renewable energy developers to enter the county’s jurisdiction and construct a renewable energy generation facility by amending its zoning regulations with several development-friendly standards.

By becoming a more renewable-friendly county, any developer looking to construct a renewable energy generation facility within the county would pay 1.5x the normal rate of the Nameplate Capacity Tax. This would increase the rate from three thousand five hundred and eighteen dollars ($3,518) per megawatt to five thousand two hundred and seventy-seven dollars ($5,277) per megawatt. The bill would add language to section 77-6203 of the Nebraska Revised Statutes to reflect this increased rate. On January 23, 2025, the Legislature referred this bill to the Revenue Committee.

LB663 (Storer) would provide new requirements and standards for county planning commissions and county boards of commissioners across the state. First, the bill would require each member of the commission and board to undertake two hours of education per term on topics specific to their role. The county attorney would develop and present said education.

Next, the bill would provide new regulations regarding the conditional or special use permit application process. The bill would specify that the commission’s or board’s granting of an application must be based solely on county zoning regulations and cannot require the applicant to apply for additional federal, state or local permitting. When making the approval determination, the bill would require these entities to presume the applicant complies with all federal, state and local requirements. Finally, the bill would require the commission or the board to decide if the application is complete within thirty (30) days. Once the appropriate entity determines the application is complete, the bill would require said entity to decide whether to grant or deny the permit within ninety (90) days. On January 24, 2025, the Legislature referred this bill to the Government, Military and Veterans Affairs Committee.

Attorneys at Baird Holm LLP have experience in many areas of the law including government and lobbying, legislation, and economic development. Please do not hesitate to contact the firm should you have any questions. The remaining bills below from days one through five of bill introduction each pose to impact the real estate and renewable energy sectors in various degrees.

ECONOMIC DEVELOPMENT

LB288 (Urban Affairs Committee) proposes to redefine terms and change provisions relating to grant funding considerations under the Middle Income Workforce Housing Investment Act. The bill expands definitions of owner-occupied housing to include rent-to-own living arrangements which do not exceed ten units and removes dollar amount limits from workforce housing definitions under the Act. On January 17, 2025, the Legislature referred this bill to the Urban Affairs Committee.

LB289 (Urban Affairs Committee) would change provisions relating to cities and villages and redefine qualifying business under the Local Option Municipal Economic Development Act. The bill allows a village board of trustees to comprise of three or five members and establishes election cycles and terms for a village board of only three members. The bill also removes revenue percent cut offs from qualifying business definitions under the Act. On January 17, 2025, the Legislature referred this bill to the Urban Affairs Committee. The bill is set for a hearing on January 28.

LB290 (Urban Affairs Committee) proposes to change provisions relating to grant funding for a business park under the Economic Recovery Act. The will would limit grant funds to ninety million dollars ($90,000,000) for a nonprofit economic development organization constructing a business park within the boundaries of an inland port district within a city of the metropolitan class, or, Omaha. The bill would also prohibit grant funds from being used in the downtown or northern downtown area of Omaha. On January 17, 2025, the Legislature referred this bill to the Urban Affairs Committee. The bill is set for a hearing on January 28.

LB355 (Andersen) would alter provisions relating to census data used for tax and economic development programs. The bill aims to provide more accurate date for distributions by the Department of Economic Development by removing mentions of the federal decennial census to just focus on the American Community Survey 5-Year Estimate by the United States Bureau of the Census. On January 21, 2025, the Legislature referred this bill to the Revenue Committee.

LB366 (Riepe) proposes to create a new Legislative Economic Analysis Unit and Chief Economist. The Legislative Economic Analysis Unit would aim to provide the Legislature with independent and reliable economic information and regulatory impact analysis for existing and proposed regulations. The Chief Economist would be the Unit’s director. The bill proposes funding the Unit with a one to two percent (1-2%) contribution from each agency’s budget. Further, the bill delineates the reporting and approval requirements for major, emergency, and nonmajor rules or regulations. On January 21, 2025, the Legislature referred this bill to the Executive Board.

LB637 (Ballard) would establish the Destination Nebraska Act. The Act would encourage and promote the development of unique Nebraska sports and retail mixed-use projects to attract new sports-related industries, create employment opportunities and further strengthen Nebraska’s retail, entertainment and tourism industries. Further, the Act would provide standards and provisions for creating destination districts, areas that would contain new constructions and economic development pursuant to the Act. Finally, the bill would add a reference to these destination districts as part of the Community Development Law in Nebraska, further encouraging development under the Act. On January 24, 2025, the Legislature referred this bill to the Revenue Committee.

LB707 (von Gillern) proposes to raise the applicant standards for proposed developments in “the good life district.” The bill would require that an applicant must “sufficiently” demonstrate that a project will directly or indirectly create the required number of jobs. On January 24, 2025, the Legislature referred this bill to the Revenue Committee.

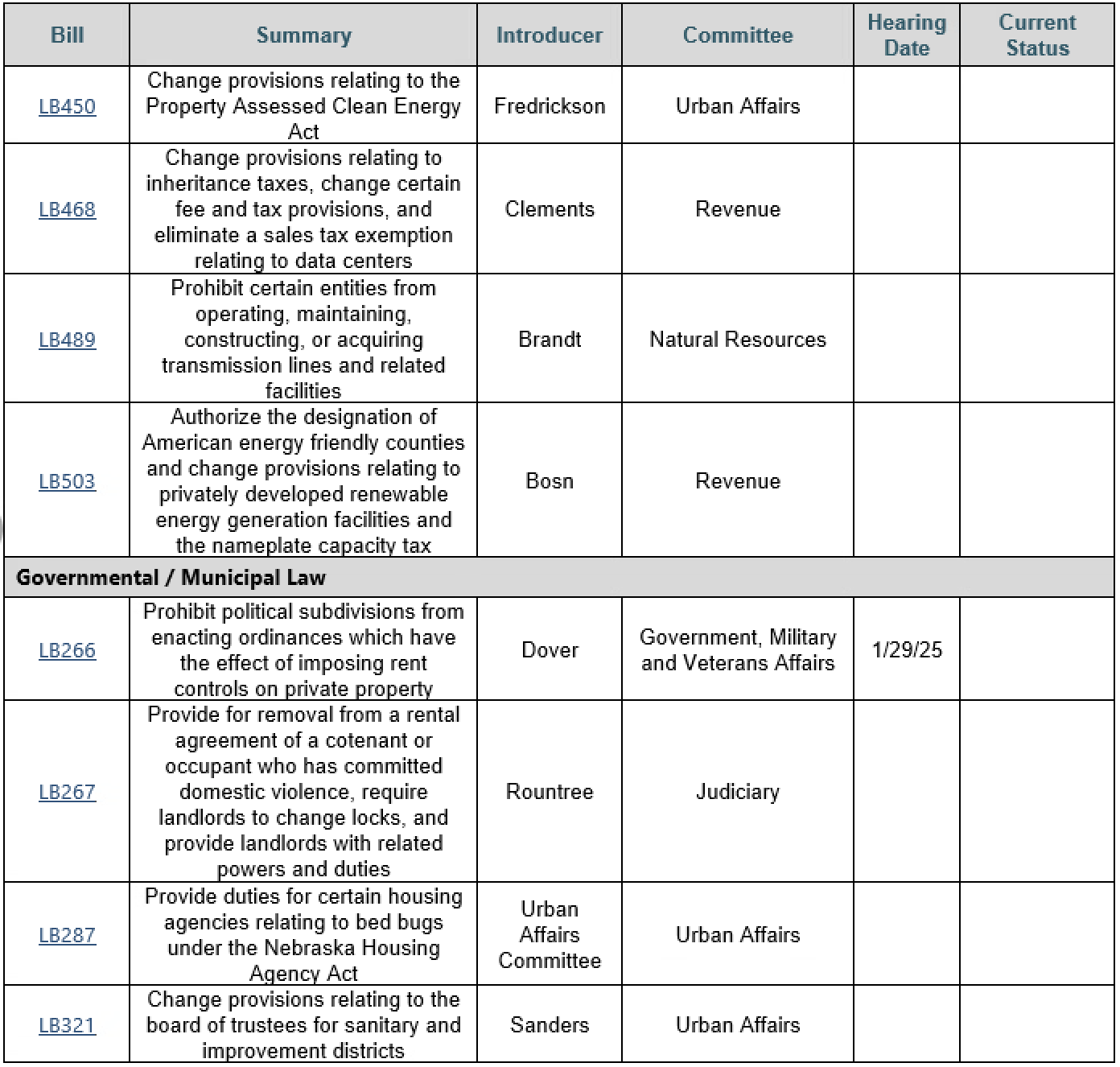

ENERGY & RENEWABLE ENERGY

LB349 (Prokop) would change existing electricity provisions to account for the construction or acquisition of certain electric energy storage resources by electric suppliers. The bill adds definitions for electric energy storage resources to existing statutes and factors such resources into existing electricity legislation addressing electric generation or transmission. On January 21, 2025, the Legislature referred this bill to the Natural Resources Committee.

LB450 (Fredrickson) proposes to amend the Property Assessed Clean Energy Act by defining and promoting “grid resiliency improvement” throughout the Act. Grid resiliency would relate to the acquisition, installation or modification of property that is designed to withstand and respond to major power disruptions within the state. The bill would include concepts such as backup power generators, solar panels with battery storage, backup power generators powered by renewable energy sources and smart grid technology as examples of promoted grid resiliency facilities. On January 23, 2025, the Legislature referred this bill to the Urban Affairs Committee.

LB468 (Clements) – please see summary at beginning of article.

LB489 (Brandt) would clarify that any electric supplier as defined in section 70-1001.01 of the Nebraska Revised Statutes must apply to the Nebraska Power Review Board before constructing or acquiring any generation facility, transmission line or related facility carrying more than seven hundred (700) volts. Further, the bill would prohibit any private electric supplier from constructing or acquiring “any transmission line or related facility.” This would not affect any transmission line a prohibited entity operated, maintained, constructed or acquired prior to the effective date of the bill. On January 23, 2025, the Legislature referred this bill to the Natural Resources Committee.

LB503 (Bosn) – please see summary at beginning of article.

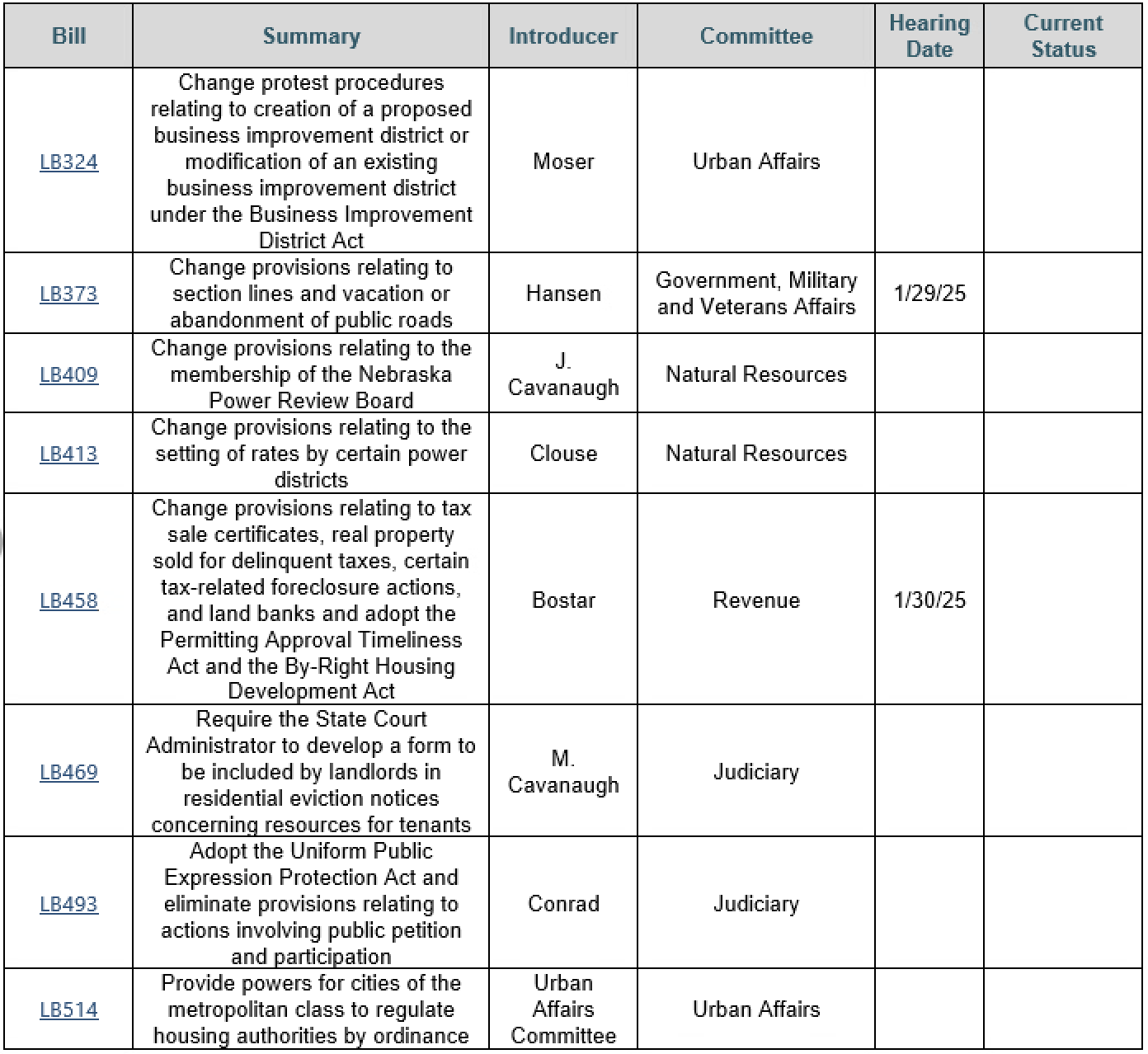

GOVERNMENTAL & MUNICIPAL LAW

LB266 (Dover) proposes to prohibit any local government from adopting an ordinance that would impose rent controls on private property. The bill explicitly states, however, the bill does not apply to any ordinance relating to increasing the supply of affordable housing through land-use or inclusionary housing requirements. It also does not apply to any ordinance that provides for a situation where a private property owner voluntarily and contractually agrees to participate in a program that restricts rent and rent increases. On January 17, 2025, the Legislature referred this bill to the Government, Military and Veterans Affairs Committee. The bill is set for a hearing on January 29.

LB267 (Rountree) would provide victims of domestic violence greater recourse in expelling their perpetrators from the living unit. The bill proposes to add measures like removing the perpetrator from the rental agreement, allowing landlords and tenants to rekey the locks on the unit, and allowing law enforcement to intervene. Further, it proposes to protect the victim by allowing the victim to alter their channel of communication with the landlord so that the victim may safely engage with the measures outlined just above. On January 17, 2025, the Legislature referred this bill to the Judiciary Committee.

LB287 (Urban Affairs Committee) proposes to amend the Nebraska Housing Agency Act by addressing issues related to bed bugs. The bill would compel housing agencies for cities of the metropolitan class to inspect units for bed bugs and notify prospective tenants and adjacent units if the agency finds evidence of the same. It would also compel these housing agencies to respond to complaints of bed bug infestations in a reasonable manner, inspect the unit within a reasonable time, obtain remedial measures for the infestation, and keep written records pertaining to all complaints and control measures the agencies provide. On January 17, 2025, the Legislature referred this bill to the Urban Affairs Committee.

LB321 (Sanders) would alter the election cycle for the board of trustees of a sanitary and improvement district. Currently, the required voters elect members of the board every four years after the first election of the trustees. The bill would create a new cycle where legal property owners would elect two members of the board and all owners of real estate located within the district would elect three members four years and every six years. On January 21, 2025, the Legislature referred this bill to the Urban Affairs Committee.

LB324 (Moser) proposes to add mailed voting postcard requirements to various assessment and tax provisions under the Business Improvement District Act. The bill would compel city councils seeking to create a business improvement district through a special assessment or occupation tax to mail voting postcards to the record owners and users of the proposed business improvement district. If less than fifty percent of the voters return the postcard vote in favor of the proposes business improvement district, the city council must terminate the proceedings. On January 21, 2025, the Legislature referred this bill to the Urban Affairs Committee.

LB373 (Hansen) would change provisions relating to section lines, vacation, and abandonment of public roads. The bill would specify that current section lines are declared, but not required to be, public roads in each county. The bill proposes to allow county boards of supervisors to pass resolutions to open such public roads on section lines when needed and remove study requirements when recommending to the county highway superintendent that a road be vacated or abandoned. On January 21, 2025, the Legislature referred this bill to the Government, Military and Veterans Affairs Committee. The bill is set for a hearing on January 29.

LB409 (Cavanaugh, J.) proposes to alter membership requirements for the Nebraska Power Review Board. If the bill is passed, once existing board members complete their terms or resign, the bill would require future Nebraska Power Review Boards to consist of at least one engineer, one attorney, one licensed journeyman electrician, and two additional persons. On January 22, 2025, the Legislature referred this bill to the Natural Resources Committee.

LB413 (Clouse) would alter provisions relating to public power and irrigation districts’ ability to set rates. The bill would allow rates and charges to be differentiated based on load size, load factor, firm or nonfirm service, technology risks, length of service commitment, and other objective criteria. On January 22, 2025, the Legislature referred this bill to the Natural Resources Committee.

LB458 (Bostar) – please see summary at beginning of article.

LB469 (Cavanaugh, M.) proposes to amend the Uniform Residential Landlord and Tenant Act by adding eviction notice requirements. Beginning February 1, 2026, the bill would compel landlords to include a prepared form with every eviction notice they provide to a tenant. This form would include information about legal assistance, financial resources and instructions regarding how to report housing discrimination. On January 23, 2025, the Legislature referred this bill to the Judiciary Committee.

LB493 (Conrad) would establish the Uniform Public Expression Protection Act. The Act would provide where and when a party may bring a claim, the standards for such proceedings and how a court shall award various costs related to the proceedings. On January 23, 2025, the Legislature referred this bill to the Judiciary Committee.

LB514 (Urban Affairs Committee) proposes to give cities of the metropolitan class (Omaha) the ability to regulate housing authorities via ordinance. This would include concepts like providing pest control, regular inspections of managed properties and penalties for code violations. On January 23, 2025, the Legislature referred this bill to the Urban Affairs Committee.

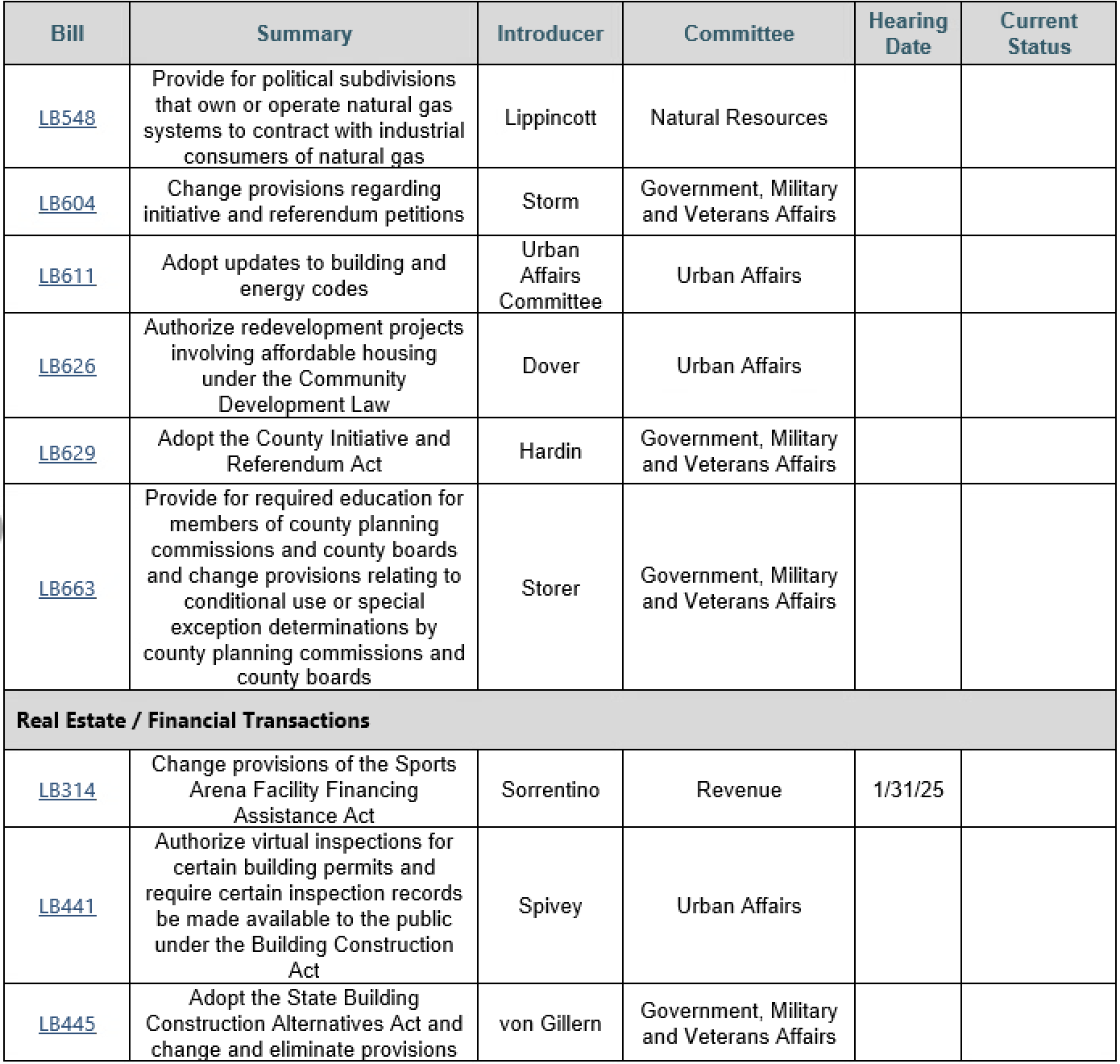

LB548 (Lippincott) would allow any political subdivision that owns and operates a natural gas system to enter into a contract to sell said natural gas to industrial consumers. Those industrial consumers must reside in Nebraska, cannot be a consumer of any investor-owned or governmentally-owned gas system for purposes of the contract and must require at least three billion (3,000,000,000) British thermal units of natural gas per day, on average. The bill would require the contract lasts for at least two years. On January 24, 2025, the Legislature referred this bill to the Natural Resources Committee.

LB604 (Storm) proposes to revise the filing, posting and suit process regarding initiative petitions. First, the bill would require the Secretary of State to post the text of the sample petition to the Secretary of State’s website and send notice that the measure is in circulation once they receive a copy of said petition. Next, if the Secretary of State refused to place the measure on the ballot, the bill would require them to announce their refusal on the same date they post and circulate the petition. Finally, the bill would provide new standards for claims and defenses regarding these petitions. On January 24, 2025, the Legislature referred this bill to the Government, Military and Veterans Affairs Committee.

LB611 (Urban Affairs Committee) would revise section 71-6403, adding new resources to the International Residential Code. It would also change which version of the International Building Code a local governmental entity may adopt for their building or construction code to remain in compliance. Finally, it would require the Legislature to adopt the 2021 version, rather than the 2018 version, of the International Energy Conservation Code to ensure new constructions meet minimum energy efficiency across the state. On January 24, 2025, the Legislature referred this bill to the Urban Affairs Committee.

LB626 (Dover) proposes to define “affordable housing” within the confines of Community Development Law. The bill would also amend the definitions of “blighted area” and “substandard area” to include areas in which less than twenty percent (20%) of the area contains affordable housing. Finally, the bill would specify that a lack of affordable housing in an area contributes to the increase of economic and social liabilities, hindering community growth. This in turn would declare that affordable housing is a state issue the Legislature must address. On January 24, 2025, the Legislature referred this bill to the Urban Affairs Committee.

LB629 (Hardin) would establish the County Initiative and Referendum Act. This Act would reserve the powers of initiative and referendum with qualified electors in each county, allowing them to amend or repeal measures affecting the governance of their county. On January 24, 2025, the Legislature referred this bill to the Government, Military and Veterans Affairs Committee.

LB663 (Storer) – please see summary at beginning of article.

REAL ESTATE & FINANCIAL TRANSACTIONS

LB314 (Sorrentino) proposes to add an additional avenue to apply for state assistance under the Sports Arena Facility Financing Assistance Act. The bill would allow an entity to apply if each co-applicant described in section 13-3102(1)(b) (entities with an approved revenue bond issue or general obligation bond issue to construct, improve, equip or acquire an eligible sports arena) has adopted a resolution authorizing the political subdivision or the nonprofit corporation to pursue such financing. It would also allow an applicant to convert the temporary approval of the board, as defined by section 13-3102(2), to a permanent approval if the applicant receives a building permit within 24 months of the temporary approval. On January 21, 2025, the Legislature referred this bill to the Revenue Committee. The bill is set for a hearing on January 31.

LB441 (Spivey) would define “authorized inspector” and “inspection records” for purposes of the existing Building Construction Act. The bill would also allow any state agency, county, city or village that requires an inspection as part of a building permit to hold a virtual inspection with an authorized inspector. Finally, the bill would compel any entity who performs such a virtual inspection to make the inspection records available to the public. On January 23, 2025, the Legislature referred this bill to the Urban Affairs Committee.

LB445 (von Gillern) proposes to establish the new State Building Construction Alternatives Act. The Act would provide the state building division alternative methods for contracting for state buildings it has responsibility of under section 81-1108.15 of the Nebraska Revised Statutes. The Act would specify the process and details for selecting a design-builder and entering into a design-build contract. It would also specify the process and details for selecting a construction manager and entering into a construction manager-general contractor contract. Finally, it would amend several existing statutes to reflect the Act. On January 23, 2025, the Legislature referred this bill to the Government, Military and Veterans Affairs Committee.

LB447 (Cavanaugh, J.) would allow government authorities from Nebraska cities and villages to employ laborers, mechanics and apprentices to perform construction work under a redevelopment contract. This work would fall under the new subsections (6) and (7) of section 18-2119 of the Nebraska Revised Statutes the bill also proposes. These new subsections would ensure a percentage of the laborers hired under these contracts would be apprentices, allowing individuals new to the workforce to gain experience and knowledge within the field. On January 23, 2025, the Legislature referred this bill to the Urban Affairs Committee.

LB476 (Guereca) proposes to clarify that certain entities holding a property interest in land are not in violation of the Foreign-owned Real Estate National Security Act. These include persons who acquired an interest in land while as a class of alien authorized to accept employment under 8 C.F.R. 274a.12 or those who acquired the property before they met the definition of a nonresident alien. On January 23, 2025, the Legislature referred this bill to the Agriculture Committee.

LB614 (Andersen) proposes to allow any city of the first class to exempt certain farm buildings from zoning and property use regulations and building, electrical, plumbing and other ordinances within said city’s extraterritorial zoning jurisdiction. The bill would allow any city of the second class or village to do the same. On January 24, 2025, the Legislature referred this bill to the Urban Affairs Committee.

LB652 (Hansen) would terminate the Board of Educational Lands and Funds and immediately transfer control of all school lands to the Department of Administrative Services on July 1, 2027. As the leases on the lands expire, the Department would then sell the lands under their control. The person leasing the land would have the right of first refusal to buy the land. However, if they did not buy it, the Department would sell the land at auction, remitting the proceeds to the State Treasurer for credit to the permanent school fund for Nebraska. On January 24, 2025, the Legislature referred this bill to the Education Committee.

LB696 (Raybould) proposes to revise the Professional Landscape Architects Act by altering the application process for accreditation. The bill would allow the Canadian Society of Landscape Architects to accredit a landscape architecture degree, in addition to the Landscape Architectural Accreditation Board, for purposes of sitting for the Landscape Architect Registration Examination. Further, it would specify that examination materials shall not be public records subject to disclosure under the Act. On January 24, 2025, the Legislature referred this bill to the Government, Military and Veterans Affairs Committee.

TAX INCREMENT FINANCING (TIF)

No legislative bills introduced in this category.

TAXATION & TAX EQUALIZATION AND REVIEW COMMISSION (TERC)

LB331 (Hardin) – please see summary at beginning of article.

LB384 (Storer) would make one major revision to section 77-1633 as part of the Property Tax Request Act. Currently, when a political subdivision of a county pursues an increased property tax request that is greater than the allowable growth percentage, it must hold a joint public hearing. One elected official from each political subdivision must attend that hearing. The bill proposes to alter this requirement, demanding that a majority of the elected members of each political subdivision must attend the hearing, not just one official. On January 22, 2025, the Legislature referred this bill to the Revenue Committee.

LB484 (Quick) proposes to amend the definition of agricultural and horticultural land for purposes of property tax assessment. Currently, entities that use agricultural or horticultural land for commercial purposes unrelated to agricultural purposes, particularly for solar or wind farms, do not enjoy lowered tax rates on their land. The bill would remove this exception, potentially allowing a lowered tax assessment on land an entity uses for those purposes. On January 23, 2025, the Legislature referred this bill to the Revenue Committee.

LB501 (Meyer) would provide new standards for assessing damaged real property for tax purposes. The bill would amend the standard for these pieces of properties by changing the definition from “destroyed” property to “damaged” property. It would also add “other events causing significant property damage” to a list of actionable events that already includes fires, earthquakes, floods and tornadoes. Finally, the bill would specify that the any county assessor that receives reports regarding damaged properties under an applicable event must submit a comprehensive report of all such properties to the county board of equalization for assessment purposes. On January 23, 2025, the Legislature referred this bill to the Revenue Committee.

LB510 (Holdcroft) proposes to adjust the general sales and use tax to a rate of five and one-half percent (5.5%) except when applied to transactions within a good life district of a city or village. Such transactions would be subject to a two and three-quarters percent (2.75%) tax rate. The bill would also provide new standards for expanding or terminating a good life district within Nebraska. On January 23, 2025, the Legislature referred this bill to the Revenue Committee.

LB613 (Andersen) would provide new standards for requesting and disseminating information pursuant to the Nebraska Revenue Act of 1967. This would include the Tax Commissioner’s ability to request additional information pertaining to the collection of local option sales taxes and a person’s ability to disclose copies of returns and return information to other municipal employees for verification purposes. Additionally, the bill would allow a municipality to request a list of businesses that filed an application to receive tax incentives under the Employment and Investment Growth Act, the Nebraska Advantage Act, the ImagiNE Nebraska Act or the Urban Redevelopment Act from the Department of revenue. On January 24, 2025, the Legislature referred this bill to the Revenue Committee.

LB699 (Strommen) proposes to allow a contractor purchasing materials under the ImagiNE Nebraska Act to elect for certain tax exemptions under the Act. The bill would allow the contractor to either certify the sales tax or remitted use tax they paid for the materials or exempt themselves from said taxes under the Act, depending on how the contractor elects to pay for said taxes. On January 24, 2025, the Legislature referred this bill to the Revenue Committee.

TELECOMMUNICATIONS

LB542 (Dover) would alter the regulations involving the relocating and payment for utility lines when a highway is in need of maintenance or repair. The bill would define a “qualifying utility facility” and “utility facility” as they relate to these regulations. Further, the bill would still specify the state shall pay for the alteration or relocation of the facilities if such a need arose during a highway project. However, the bill would also add the exception that another entity must pay for the alteration or relocation if there is a rule, permit, agreement, franchise or other authorization in place to the contrary. On January 24, 2025, the Legislature referred this bill to the Transportation and Telecommunications Committee.